|

Struthers Memorial Church and the 2009 accounts | |||

|

|

|

|

|

|

Introduction

When we put online the article about “the generous gift" in February 2011 we indicated that there would be an article at a later date looking more fully at the Struthers Memorial Church 2009 accounts. The information that we have is what has been placed already in the public domain, and the report and accounts which the church as a Scottish charitable company are obliged to make publicly available. The most recently published acounts relate to the year up to the end of 2009 – the situation as it was 19 months ago.

Based on past years, we would not anticipate any new accounts becoming publicly available until around September 2011 which will relate to the year ended 2010. By that time the information contained in them will be 9 months out of date.

Please bear this in mind when reading this article. Over the last 19 months the situation may well (in fact must) have changed significantly.

We think it is right and proper that anyone who is interested can consider and discuss information which has been made publicly available and provides some insight into what is happening in Struthers Memorial Church.

| |||

|

Facts lifted from the Report & Accounts | |||

|

|

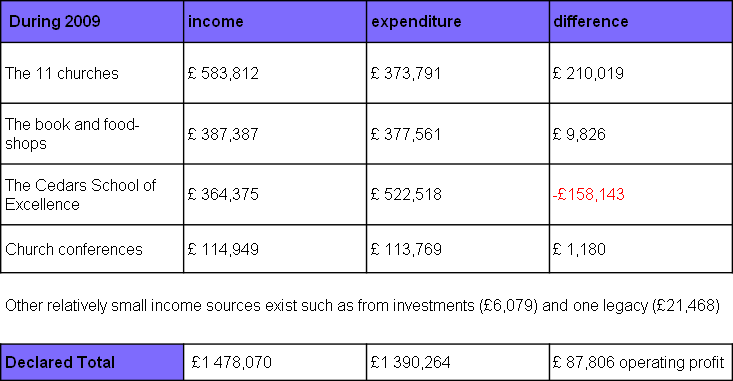

In our view the church has 4 easily understood cost centres

The 11 churches The book and food- The Cedars School of Excellence Church Conferences

In our article on the generous gift we indiciated the reported income and expenditure for each of these in 2009 as follows.

| ||

|

| |||

|

|

|

|

|

|

We have not received any request to change this information and its accuracy has not been challenged. The figures come from the report and accounts.

| |||

|

There are also 3 other major factors to consider when looking at the income and expenditure within SMC in 2009.

· Property · Money in the bank · Loans owed by the charity

|

| ||

|

|

|

|

|

|

Property | |||

|

at the start of 2009 the church owned property was valued at £ 2,379,110 (a) (two million three hundred and seventy nine thousand one hundred and ten pounds)

during 2009 there was:

spend on the purchase of a church building in Neath and the latest extension of the Greenock building totaling £ 474,739 (b)

by the end of the year buildings were valued at £ 2,853,849

(which appears to be the start of year value (a) plus the cost of the new property spend in 2009 (b))

by the end of 2009 after depreciation was calculated this net book value was given as £ 2,463,822

(this compares to the net book value of £ 2,046,160 the previous year)

| |||

|

Money in the bank | |||

|

The cash bank balance (R&A page 9)

at the start of 2009 the money in the church bank account was £ 107,010

by the end of the year the money in the account was £ 11,914

| |||

|

Loans owed by the charity (R&A page 14 note 10) | |||

|

at the start of 2009 the church owed creditors:

due after more than one year £ 109,775 due within one year £ 85,634

TOTAL owed to creditors on 1 Jan 2009 £ 195,409

by the end of 2009 the church owed creditors:

due after more than one year £ 268,495 due within one year £ 114,780

TOTAL owed to creditors on 31 Dec 2009 £ 383,275

| |||

|

In other words according to the last set of accounts the church has published they show the charity had at that point debts amounting to more than three hundred and eighty three thousand pounds | |||

|

|

|

|

|

|

Issues and questions arising from the 2009 Report & Accounts | |||

|

|

| ||

|

1 THE GRANT MAKING POLICY FOR ASSISTED PLACES IN THE SCHOOL | |||

|

There is reference to a grant making policy to help those who would suffer financial hardship in sending their children to a private school.

"the church.......provides assisted funding by way of sponsorship to enable children from households with inadequate personal funding to attend Cedars School of Excellence. The charity is not able to respond to applications for grant funding either by individuals or groups." R&A Page 3

There is no indication of how much is given in this way. We think there should be. This would remove any fear that this claim of "public benefit" in "providing assisted funding by way of sponsorship" is based on very little substance, or very little fairness.

· Several of the leading Scottish private schools have specifically moved to demonstrate public benefit by sponsoring children from poor backgrounds, such as those from families on benefits, or very low poverty level incomes, to gain a better chance in life via access to private education. Are any of the recipients of this "assisted funding" provided by the Struthers church from families on benefits, or from families who would be considered in genuine poverty? What are the criteria for selection?

· What is the total amount paid out in grants for assistance with school fees? This will enable those who give money to Struthers Church to know how much of the total fees income of £364,375 is actually coming from paying parents and how much is coming from church funds (via a fees grant) back into the Struthers company. In our article on "the generous gift" we have indicated that there is already a subsidy from the churches collections to the school amounting in 2009 to £158,142.

· If “no response to applications for funding" is the declared policy of the SMC directors how do cases deserving of sponsorship come to their attention? Is the system for establishing needs and allocations fair and open to scrutiny? Or is there the danger that the assistance has been awarded in a way which looks after people who are more likely to be already linked to the Directors friends, families or church members?

· How much of the total "assisted funding" grant has gone to help with the fees of children whose parents belong to Struthers Church?

· How much has gone to help with the fees of non Struthers church children?

· Has any such grant been made to assist the fees of children, or grandchildren, or family, of SMC directors, church leaders or anyone who works in the school?

| |||

|

2 DEFINITION OF MEMBERSHIP IN THE NEW STRUTHERS CHARITABLE COMPANY | |||

|

There are 6 directors of the Struthers Memorial Church charitable company established in December 2007:

| |||

|

|

Christopher Jewell Jenifer Jack Grace Gault Pauline Anderson Diana Rutherford Robert Cleary |

aged 64 aged 63 aged 62 aged 50 aged 50 aged 84 |

|

|

According to the Struthers company articles of association sections 1-

If so there is a strange and contradictory comment on the 2009 R&A page 4 which states:

"it has been particularly pleasing to find God working in the lives of so many members, and to find new members joining the charity by virtue of their profession of faith in Jesus Christ and their regular attendance at our services."

“New members joining the charity.....by virtue of regular atendance at services” seems to be in conflict with the definition of membership in the articles of association where "membership" of the company is defined as being at the gift and control of the 6 directors and has voting rights associated with it.

Perhaps the Stuthers Memorial Church directors could explain what they mean by membership in each case?

QUESTIONS:

Who is and who is not a member of the new Struthers Memorial Church company established 19 December 2007?

Is there a membership system or records?

Does this system also include listings of those banned from membership?

Or are the only real “members" the 6 directors and their nominees who become directors

-

Who is entitled to attend the AGM or any other members meetings?

| |||

|

3 THE FREE RESERVES POLICY | |||

|

In the 2009 accounts page 4 it is stated:

"The directors recognise that the low level of reserves is not ideal and therefore pursues a policy of maintaining free reserves at a level to cover at least 3 months running costs."

We assume that the low level of reserves refers to available cash in the bank at the end of 2009 which was £11,914.

An indication of what this policy would require is easy to calculate.

Unless there is another way to define "free reserves" other than as money in the bank then it appears the organisation had (and possibly still has) a long way to go before it would be in a position to assure it's employees; and it's attendees; and it's contributors; it’s auditors and the Office of the Scottish Charity Regulator that it has this intended level of "free reserves" in place.

In fact, the situation appeared to be worse, as the organisation was also in considerable debt. The money owed out by the charity amounted to £ 383,275. (see section 7 on loans below) and has an outstanding capital commitment of £31,000 (see note 18 to the accounts).

QUESTIONS:

The SMC directors committed in their public report and accounts to pursue a policy

to have in place this level of "free reserves". Now -

If the organisation is not yet there in July 2011 – by what date are the SMC Directors currently planning to be in the position to say they have implemented their declared policy of having 3 months running costs available in "free reserves"?

| |||

|

4 THE STRATEGIC PLANNING FUND | |||

|

There is an entry in the Report and Accounts on page 14 indicating that £105,275 has been set aside by the church for "strategic planning".

We think it is fair to say that this is an odd entry. What does one hundred thousand pounds of strategic planning for a church look like in practice? What this money is (or was) for is not at all apparent.

Could the directors explain to the members and the public what £105,275 was being "designated" for? This amount is in addition to the Governance costs which “include… costs linked to strategic management of the church (from Resources Expended, page 10).

We accept that the answer may be very simple and very straightforward but it is a large amount to have dedicated to an unidentified purpose.

| |||

|

5 THE "FIDRA" PROPERTY | |||

|

Fidra Operations (Ardgowan Street, Greenock) Funds are given and used to provide and maintain the Fidra property (R&A page 15 section 11)

There seems to be a fund standing at about £15,000 for a pupose called "Fidra Operations". What that activity is is not in any way made clear in the Report and Accounts.

We think the directors should make it more transparent what that activity is and who in the church, or outside the church, is benefiting from that fund?

Again, we accept that the answer may be very simple and very straightforward.

| |||

|

6 BOOKS PUBLISHED BY THE CHURCH | |||

|

"Stocks are valued at the lower of cost and net realisable value. Books written by Hugh B Black and published by the fellowship are valued at the cost of production." (R&A page 10 section 1 stocks):

Unsold New Dawn books do not appear to be accounted in the same way as other bought- (R&A page 13 section 7)

As we understand it -

Whatever the actual number of unsold books the cost to the church of printing those that remain unsold is given as nearly £50,000. (fifty thousand pounds).

| |||

|

7 CASH IN THE BANK AND LOANS | |||

|

During 2009 Struthers Memorial Church declared a total income of £1,478,070 (one million four hundred and sevently eight thousand and seventy pounds)

at the end of 2009 the church had £11,914 in its bank account

and loans owed by the church were given as totaling £383,275 (see above)

"These are secured by standard securities over certain of the church's property assets." R&A page 14 section 10

There is no information given which of the church's buildings have been set up as security for these loans or which congregations would be affected if these loans defaulted.

As a perspective – we mentioned the policy the SMC directors have declared that they pursue of "maintaining free reserves at a level to cover at least 3 months running costs" which the directors intend to achieve at at some unspecified point. This 3 months figure would be over £300,000 held as cash in the bank at any one time (see point 3 above). From this figure for loans we can see that not only are the free reserves not in place but as much as would be needed for reserves was already owed out. We think that for a charity with this number of employees and this level of committed ongoing costs this is a significant and concerning level of debt.

Given the vast charity income -

| |||

|

|

"I see something else that seems quite worrying to me. If I read the accounts correctly,

the organisation (as noted above, there is only a single organisation, which administers

the church, the school and the bookshops, so they all stand or fall together) only

managed to balance its books because of unsecured interest- | ||

|

As at July 2011 we would think it appropriate for the central treasurer to tell the attendees of Struthers Memorial Church who contribute so generously to the various activities of his organisation if this surprisingly poor cash and loan situation has improved or worsened.

We will all find out eventually when the figures for 2010 and 2011 are published

-

For those involved in producing these articles it will be interesting to see what comes out.

For those involved in Struthers Memorial Church and its related businesses, many of whom regularly give and also willingly respond to additional appeals for cash, these matters are much, much more urgent.

| |||

|

8 THE GOOD PRACTICE OF SHARING BUDGET INFORMATION IN ADVANCE | |||

|

As we understand it there are no budgets shared with the attendees and contributors to the Struthers Memorial Chuch company indicating what their giving will be contributing to over the following year. We think this is a reform that should be introduced so that people can understand and plan their giving based on full and detailed knowledge of what is planned for their money and what in the activities of the Struthers organisation it will support. This is done in many churches and charities (many with much less income that Struthers) to the benefit of all and is a good practice we would highly recommend.

It is perfectly proper and reasonable for a charity to issue a budget plan to its contributors so there can never possibly be any doubt or confusion as to where peoples money will be spent BEFORE THEY GIVE IT.

This is not a question of whether such a budget exists. We all know it does and it must – not least because SMC have 31 employees to pay every month. The question is about why the leadership have not ever since the founding of the church in 1955 shared any budget in advance with its people? Why is that? Is it possible that the leadership believe people would give less if they knew where money was being spent? Is there concern that people would be less willing to give so much if they knew whose projects and whose pockets it was going to end up in? If the leadership feel that such a question and suggestion shows terrible and shocking effrontery – we would still invite them to answer it fully.

One of the characteristics of controlling churches is secrecy and paranoia on the part of the leadership about sharing information, and in particular financial information. Full disclosure of budgets in advance and the answers to the questions we have asked in this article would make it much harder for anyone to make this allegation against Struthers. It would also make the leadership more accountable and their activities more transparent. It would most importantly ensure forever that people were giving money in the sure and certain knowledge that it would be going to support the activities and church ministries that they wanted it to support.

It is possible that in the past the leaders of the church have been diverting tithes

and collection plate income to educational, publishing or I.T. ventures which – while

perfectly legal – some of those who were contributing financially to the church feel

they were not made fully aware of. Some have contacted us and indicated that this

has been the case particularly in relation to our article on the "generous gift".

Some people were genuinely shocked at how much of the money they gave to their local

branch church was ending up funding the Greenock school deficit. Interestingly no-

We believe everyone should be given the chance to plan their giving to a church on

the basis of the church sharing in advance what that giving will be used for. We

also think that the congregation deserve -

| |||

|

|

We believe there has to be change. Holding a charity together by ensuring information is kept away from people would be wrong. Holding an AGM for the national church at 9.30 am on a Saturday morning in Greenock would not appear to be giving people across the church branches maximum opportunity to obtain and scrutinise information. It could appear to be intended to achieve the opposite.

Full sharing of a budget in advance is the best and only way that ensures the church membership is protected from error and folly by those in charge.

This church allows preaching such as was given on 12 February 2011 and discussed

in "the humiliation sermon" and "the punishment threat" – where it is taught that

to question the acts or motives of some of the leaders is a sin which God will publicly

punish. The leaders who are beyond question include -

If this teaching remains in place the opportunity for proper financial accountability to the membership is effectively rendered zero.

| ||

|

|

|

| |